Renters Insurance in and around Arlington

Looking for renters insurance in Arlington?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Tarrant County

- Parker County

- Denton County

- Arlington

- Mansfield

- Dalworthington

- Pantego

- Kennedale

- Grand Prairie

- Hurst

- Euless

- Bedford

- Irving

- Rendon

- Burleson

- Westover Hills

- Ridglea

- Ryan Place

- Woodhaven

- Fort Worth

- Grapevine

- Colleyville

- Southlake

- Westlake

Home Sweet Home Starts With State Farm

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented condo or townhouse, renters insurance can be a good idea to protect your belongings, including your boots, desk, entertainment center, furniture, and more.

Looking for renters insurance in Arlington?

Renters insurance can help protect your belongings

Renters Insurance You Can Count On

Renting a home is the right decision for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance may take care of damage to the structure of your rented home, but that doesn't include what you own. Renters insurance helps guard your personal possessions in case of the unexpected.

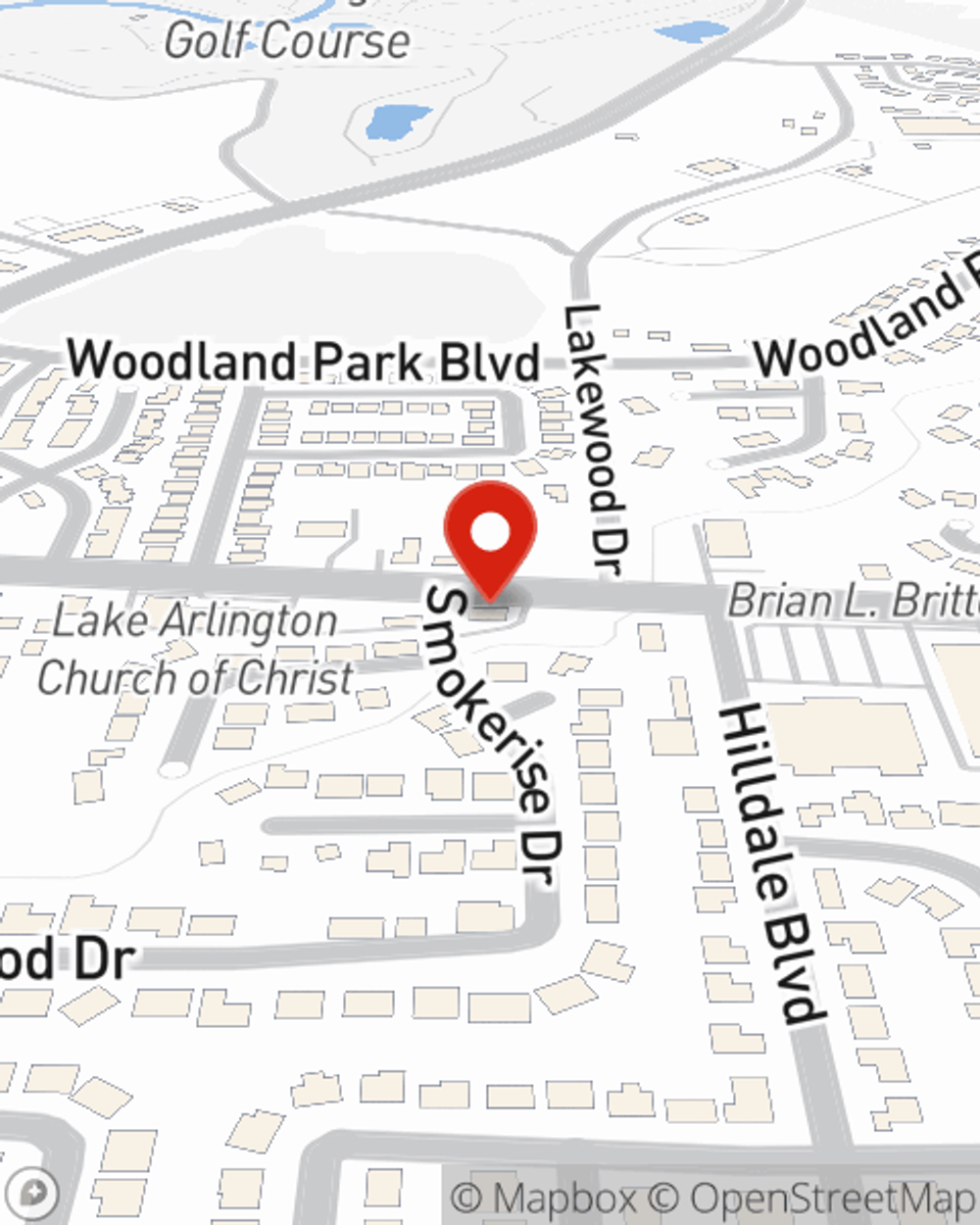

More renters choose State Farm® for their renters insurance over any other insurer. Arlington renters, are you ready to discuss your coverage options? Get in touch with State Farm Agent Mark Leal today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Mark at (682) 323-5033 or visit our FAQ page.

Simple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Simple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.